VoiceWizard Services Overview

Comprehensive Business Solutions Tailored to Your Needs

Accounting Outsourcing Service

We cover all aspects of bookkeeping, accounting, and tax preparation services for UK accounting firms. We have extensive expertise across multiple industries and business types.

Call Center Services

Our CSM profile offers customer analytics and customer life cycle management in addition to inbound and outbound call center capabilities.

Live Chat Support

Support options include email, live chat, and complaint management.

Non-Voice/Digital Engagement Platform

Data entry services, image processing capabilities, and social media management services are all included in the DEP profile.

Back Office Support

Facilities like HR Outsourcing, Document Management Services, and Transaction Processing Services are included in the BOS profile.

Digital Marketing

E-commerce, complaint management, transaction processing, and SEO features are all included in the DM profile.

We work with all popular accounting softwares.

We are familiar with industry specific accounting software. A few of the most popular ones that we work with are listed here

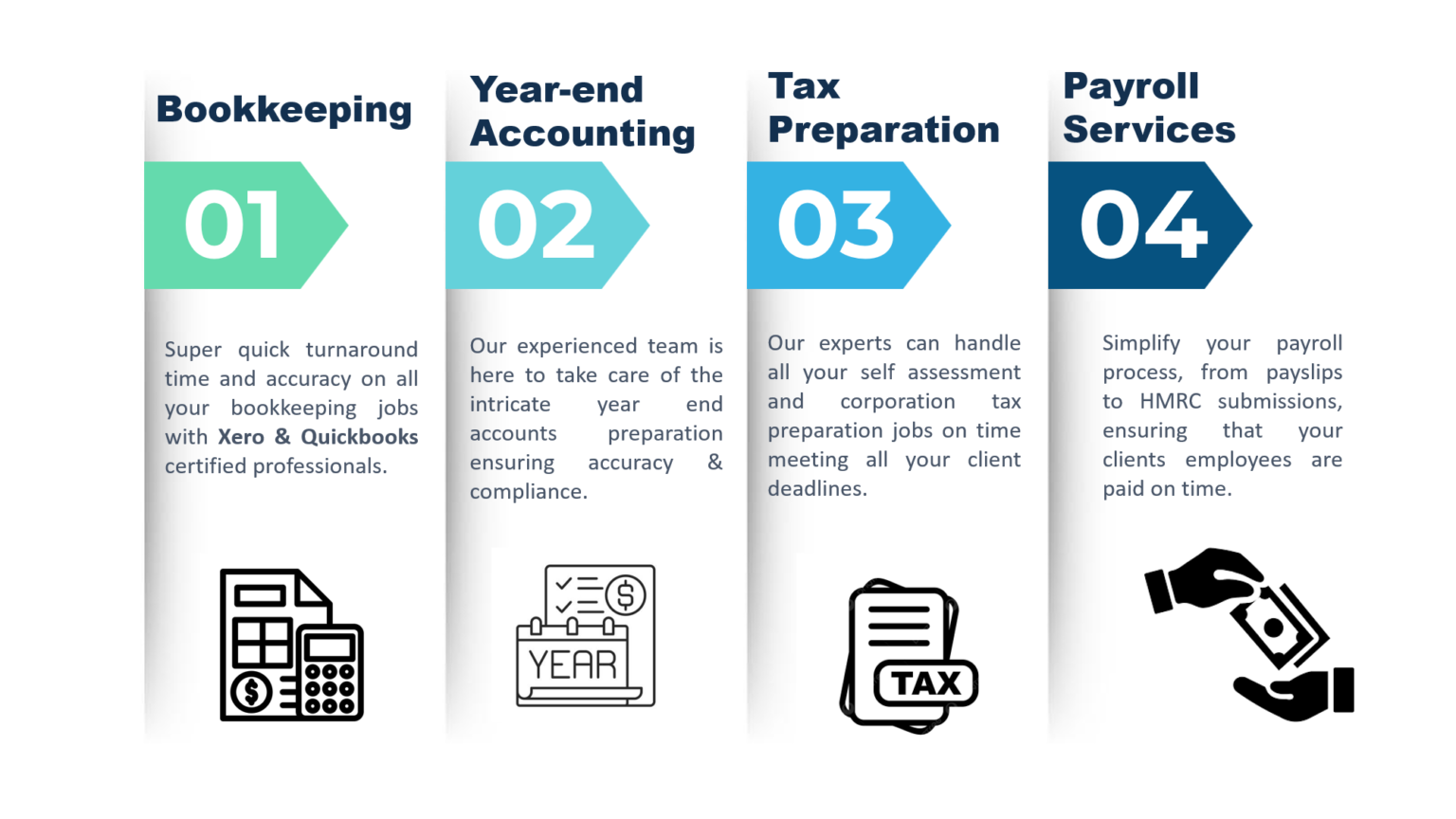

Our Comprehensive accounting outsourcing services include

VoiceWizard may be the best partner for accounting outsourcing for a variety of reasons.

- Financial Recordkeeping and Reporting: This includes daily or weekly accounting entries, bank and credit card reconciliation, VAT returns preparation, and company yearend accounts.

- Tax Compliance: This covers submission of annual returns, HMRC online submissions, personal tax returns, and corporation tax returns.

- Financial Planning and Analysis: This includes budgets and forecasting reports and management accounts.

- Payroll Management: This involves payroll processing, accounts payable, accounts receivable, and credit control.

- Company Administration: This includes company secretary service and audit file preparation.

- Compliance and Regulatory Reporting: This encompasses VAT returns preparation, submission of annual returns, and HMRC online submissions.

A Detailed Breakdown